4 Tips for Making Your Down Payment Easier

Buying a home is likely one of the biggest financial decisions you’ll ever make. If you’re thinking about buying a home, you’re not alone. In 2018, just over 6 million homes were sold. Despite that high number, there are still an unprecedented number of renters in the US. In fact, more people are renting now […]

What to Do If Your Mortgage Application is Denied

“I’m sorry … your mortgage application was denied.” Those are words no home buyer wants to hear. But sometimes it happens. Does it mean that all hope for buying a home is lost? Not necessarily. Since the mortgage approval process is rigorous, there are a number of factors that could trigger a denial. The key […]

Tips to Avoid a Mortgage Scam

Because the mortgage industry is so heavily regulated, it’s hard to believe that mortgage scams exist … but, unfortunately, they do. The most common mortgage scam is a wire fraud. This is when hackers send you fake wire transfer instructions. The good news is that with a little diligence and common sense, you can stay […]

Tips for Getting a Mortgage When You’re Self-Employed

While getting a mortgage is usually a straight-forward process, when you’re self-employed, it can get a little complicated. Even if you earn a good living from your self-employment, without a weekly paycheck and W2 to present as proof of income, your mortgage application and approval process can often involve a few more steps and more […]

Using Gift Money for Your Down Payment

Saving for a down payment can take a long time. However, if you’re fortunate to have family willing to give you a monetary gift that you can use for your down payment, you can reach your goal of home ownership must faster. According to the 2017 National Association of REALTORS® Profile of Home Buyers and […]

What to do if the Home Appraisal Comes in Low

A home appraisal is an important step when buying a home—and one that is absolutely necessary if you’re getting a mortgage. The purpose of the home appraisal is to determine the property’s actual value. Lenders require this, as it’s a way for them to protect their investment. For example, suppose you and the seller agree […]

What is an IRRRL VA refinance loan

You probably already know that many things like cAn IRRRL, or Interest Rate Reduction Refinancing Loan, is a quick VA refinance option with fewer qualifications and less paperwork than other refinance loan options. It’s meant to be a quick and non-complicated refinance option for qualified VA homeowners, and there is no appraisal requirement. If you […]

Things that Do Not Affect Your Mortgage Application

You probably already know that many things like credit score and employment history affect your mortgage application. But what about those things that don’t affect your mortgage application? Is applying for a mortgage in your future? Contact us. As mortgage bankers, we can help you make the best decision for your needs. Have Questions, Reach […]

Jumbo Loans

When shopping for a mortgage, you may have heard the phrase “jumbo loan.” What is it? And do you need one? In most locations, conventional mortgages have loan limits set in place by Fannie Mae and Freddie Mac, the two government-sponsored enterprises that buy mortgages from lenders, pool them together, and sell them as mortgage-backed […]

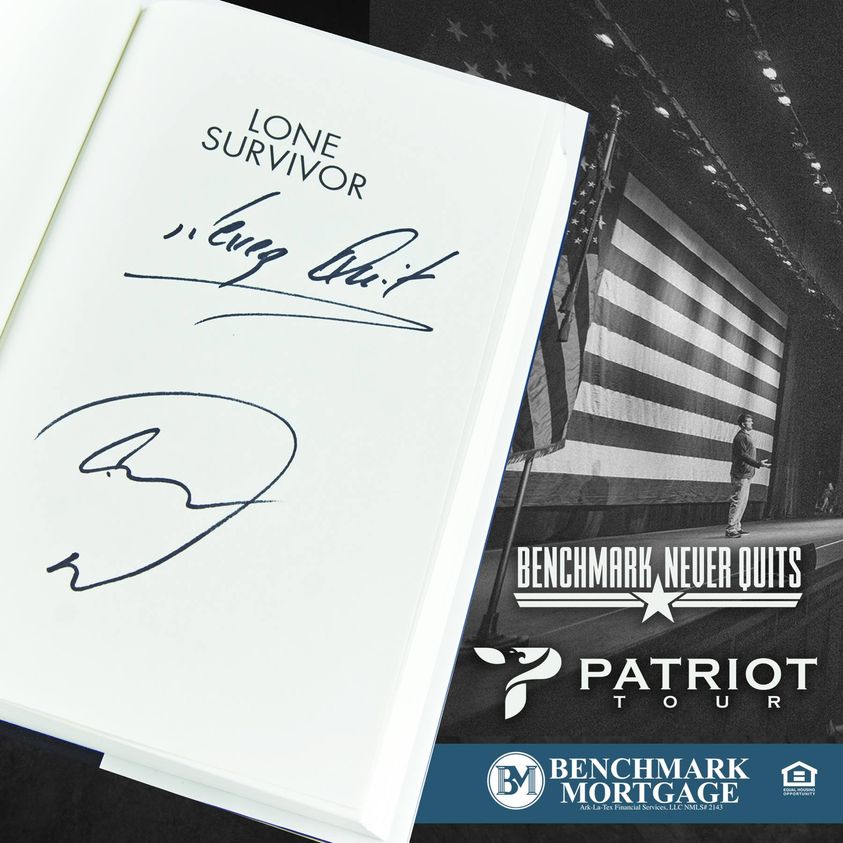

Benchmark and The Patriot Tour by Team Never Quit

This year, we will be hitting the road with the 2018 Patriot Tour! Our Team is proud to have changed the way VA lending is done, and we take a “never quit” attitude with our veterans and their dreams. NO MORE will the veteran be taken advantage of. We have a heart and passion for […]